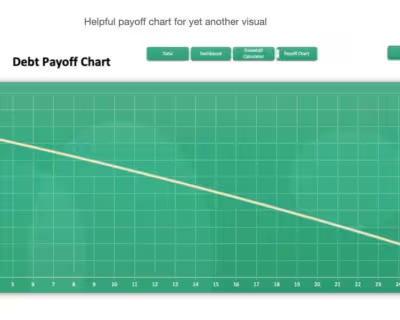

Debt Snowball vs Avalanche Calculator for Excel and Google Sheets

$14.99

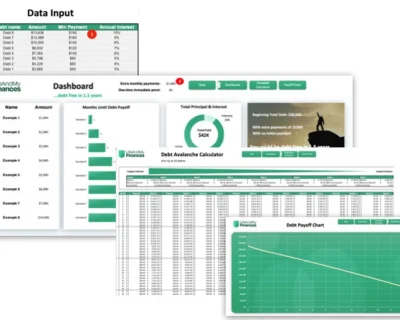

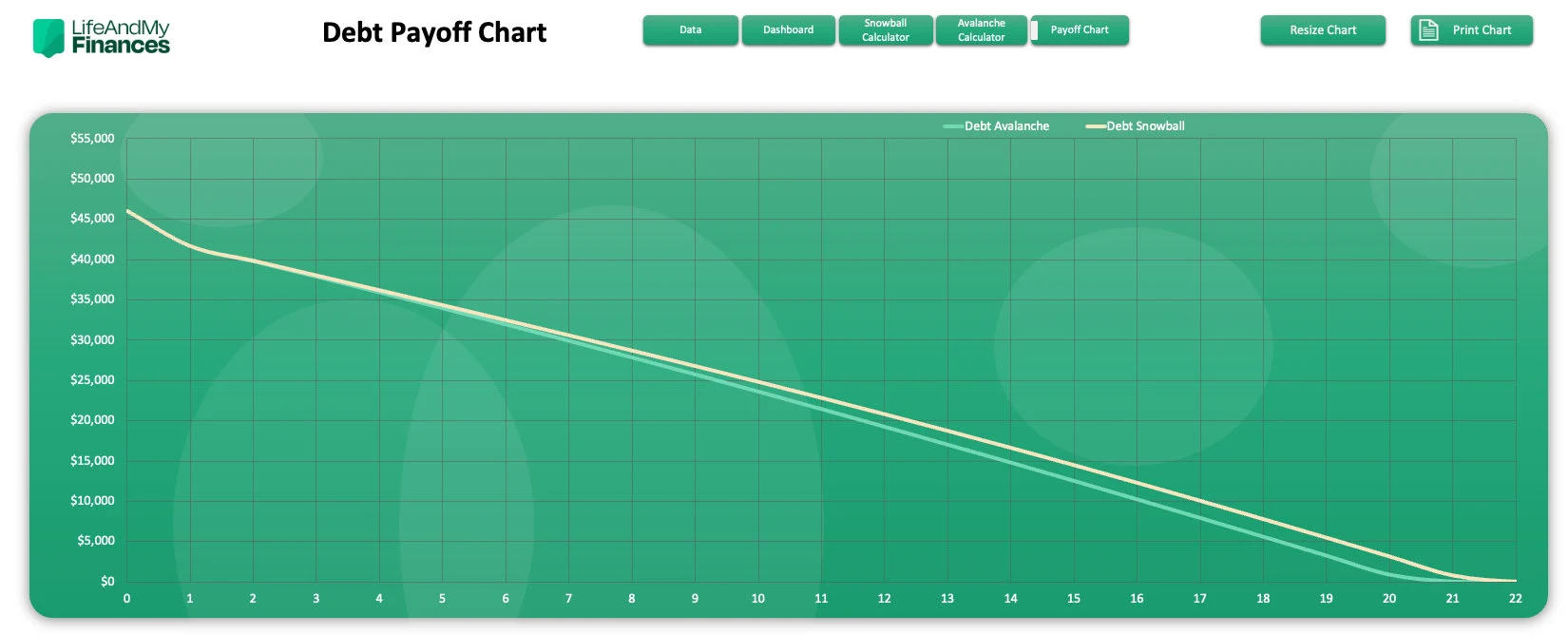

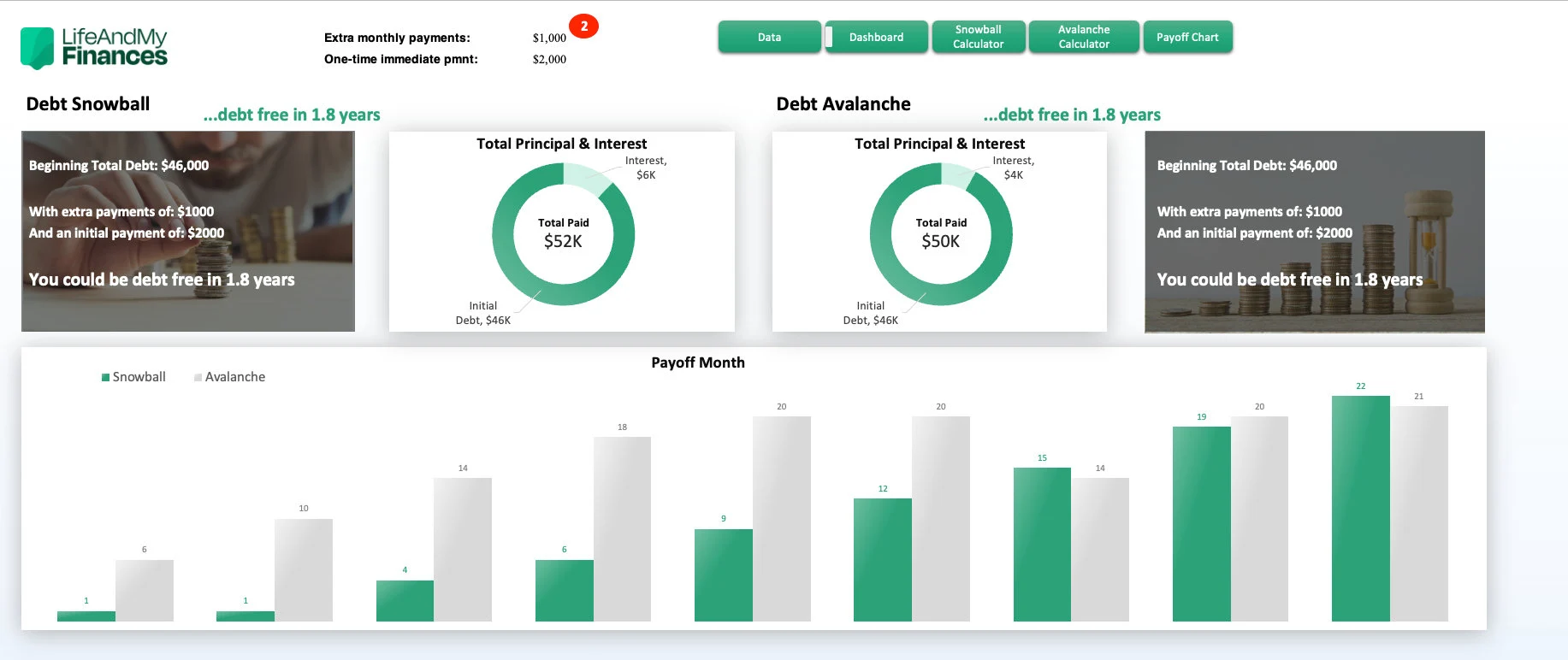

The debt snowball or the debt avalanche? This template will give you answers 💡

Works with Google Sheets and Excel

Top Features

- Compare which method works for YOU

- Fully automated and beginner-friendly

- Get debt snowball and debt avalanche templates in one with all the features!

Description

Ready to pay off your debts but…

- Not sure which method to pick?

- Ever wonder which method will pay off the fastest?

- The debt snowball or the debt avalanche?

- Paying off debts from smallest to largest?

- Paying off the highest interest to the lowest interest?

Wonder no more.

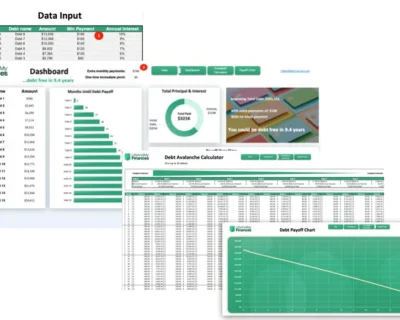

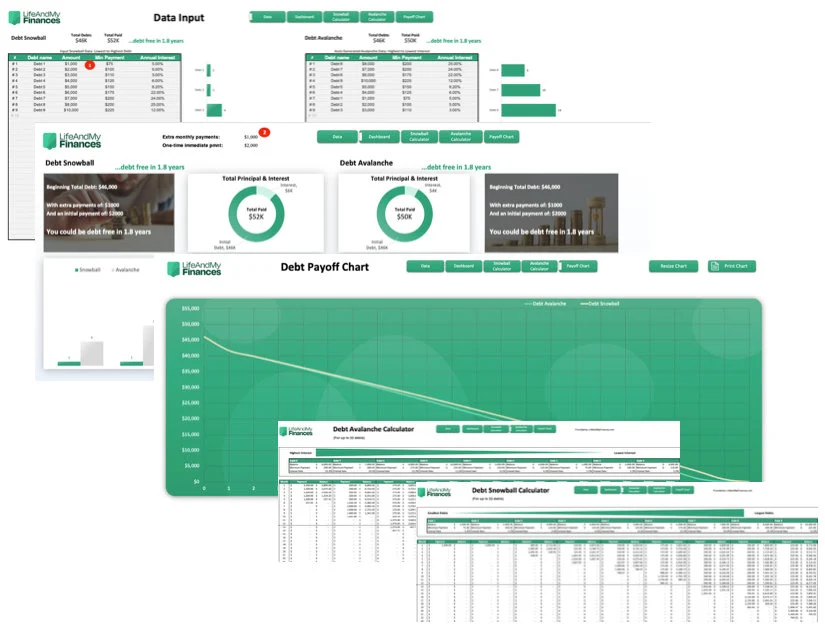

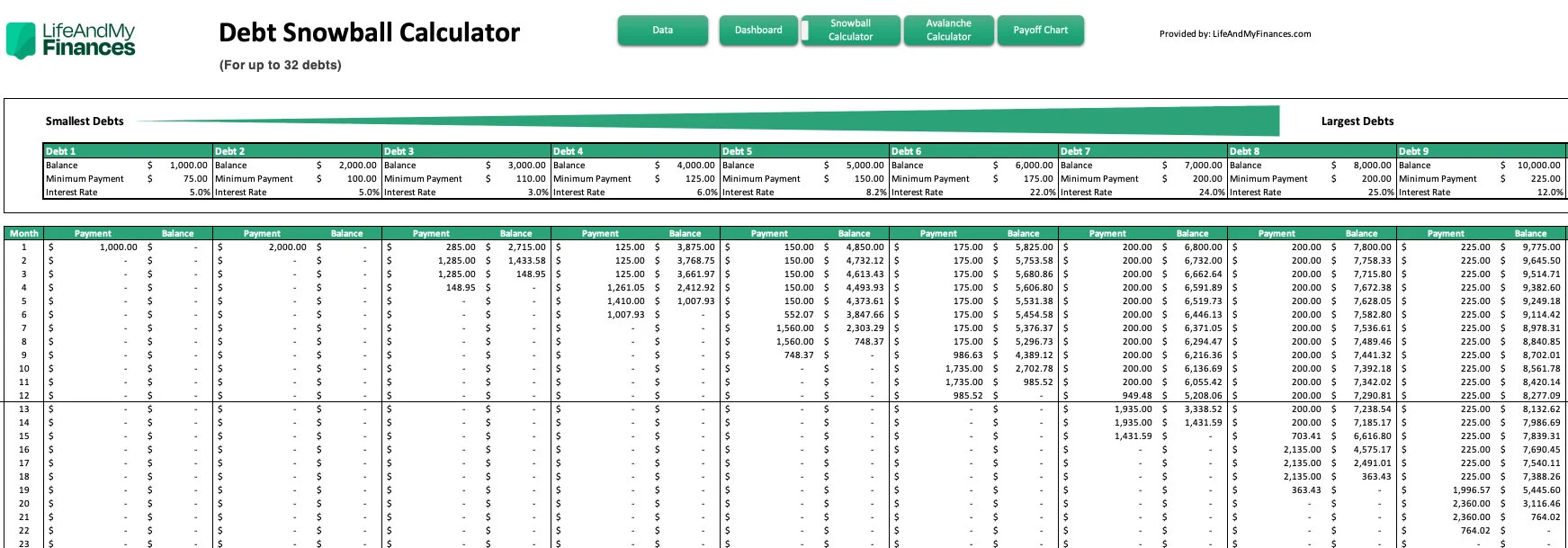

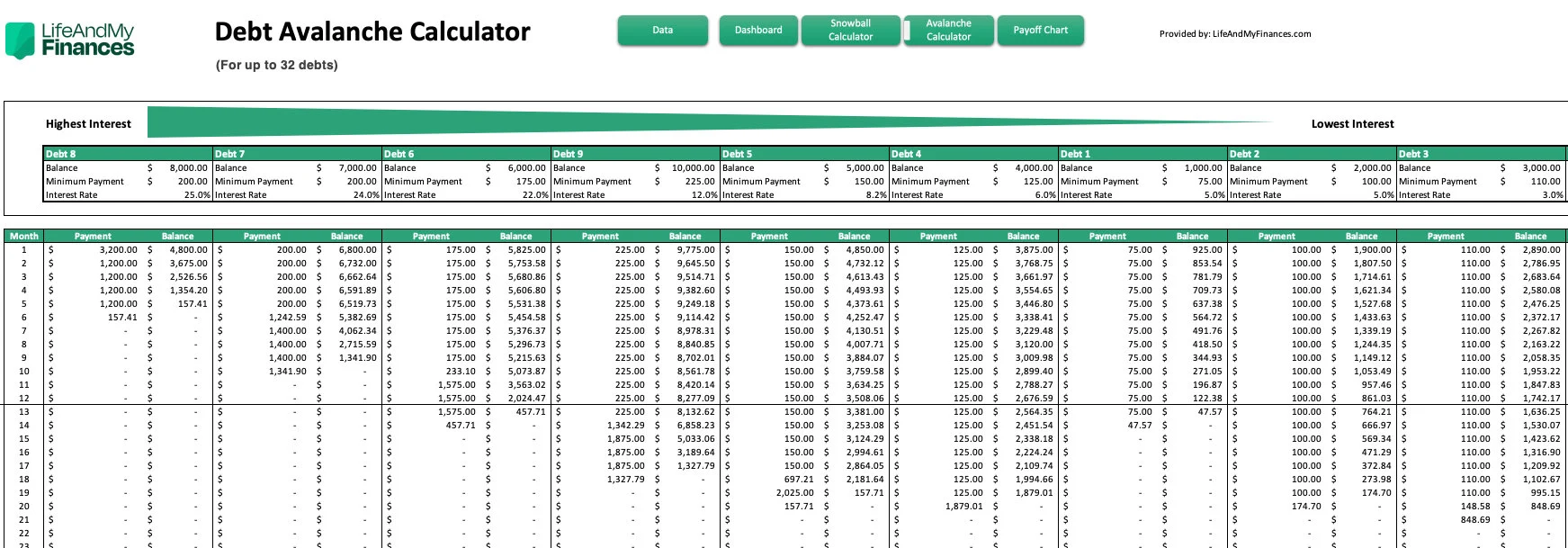

This debt snowball vs avalanche Excel spreadsheet contains both:

Yes, that’s right, this includes tabs for the full debt snowball and the full debt avalanche tools! A $19.98 value just for those! And this tool is only $14.99!! 🤑

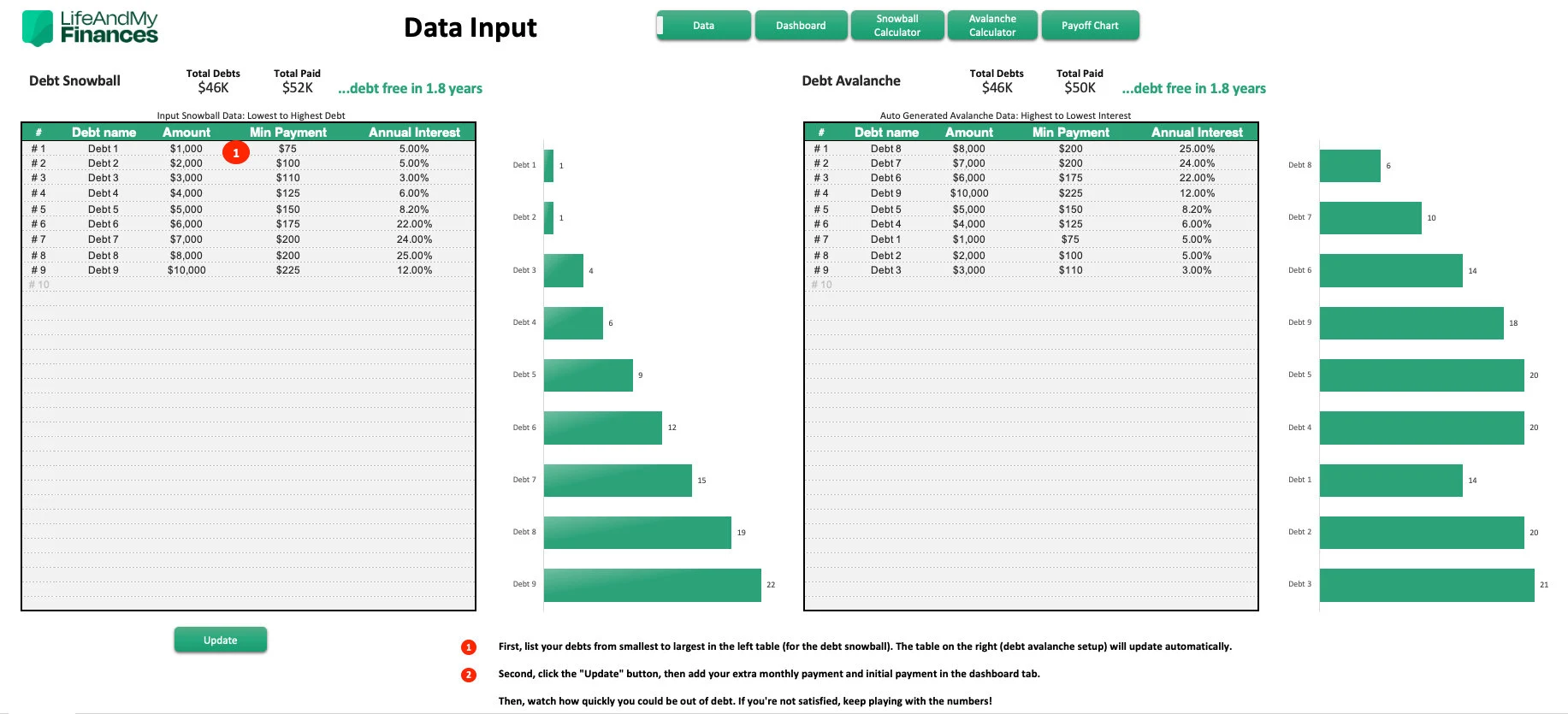

Simply insert your debts into both and see how quickly you can pay them off with the debt snowball method vs the debt avalanche method.

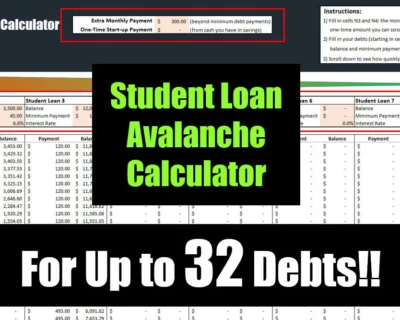

With this debt snowball vs avalanche Excel calculator, you can even add a monthly amount or a one-time initial amount.

This way, you can see how much quicker you could pay off your debts by putting more money toward your snowball or avalanche!

This may all sound confusing, but this tool takes care of all the calculations and even automates the majority of your inputs!

Just enter your debts, and any additional amounts you’d like to make, and then click one button. That’s all you need to do!

Oh, and it’s available for Microsoft Excel and Google Sheets (you will get 2 files, you’ll see).

38 reviews for Debt Snowball vs Avalanche Calculator for Excel and Google Sheets

You may also like…

-

Debt Snowball Spreadsheet for Excel and Google Sheets

4.63 out of 5$9.99 Select options This product has multiple variants. The options may be chosen on the product page -

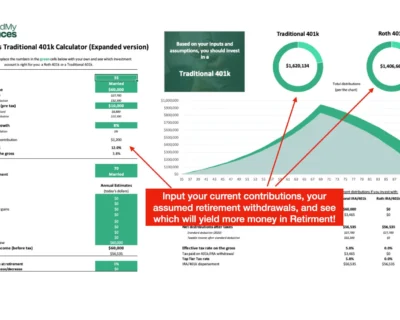

Roth 401k vs Traditional 401k Calculator for Excel

4.50 out of 5$9.99 Add to cart -

Debt Avalanche Spreadsheet for Excel

4.55 out of 5$9.99 Select options This product has multiple variants. The options may be chosen on the product page

Related products

-

Student Loan Debt Avalanche Calculator for Excel and Google Sheets

0 out of 5$6.99 – $9.99 Select options This product has multiple variants. The options may be chosen on the product page -

Credit Card Payoff Template for Excel

4.57 out of 5$6.99 – $9.99 Select options This product has multiple variants. The options may be chosen on the product page -

Student Loan Debt Snowball Calculator for Excel and Google Sheets

0 out of 5$9.99 Select options This product has multiple variants. The options may be chosen on the product page

Savoy W –

Just what I needed. Thanks!

Lyn Janiluinas –

Thank you, it’s great. 😊

carly k –

Very useful and easy to understand.

Becki Holley –

This is a very helpful product.

Evan –

Great product, met my expectations exactly as described!

Robert Babcock –

It wasn’t quite what I was looking for, but it would have been more fantastic to me a few years back. I thought I could put the date & payment I made and it would auto adjust the new payoff date and each payment and date it would re-adjust the payoff date

Jason –

I was looking for a “great” excel template that would help me track my debt using the “snowball” method. There were several “generic” options but they were all junk. This is the one to get!

Susan Bain –

Easy to use, great visual tool to get a handle on debt.

Tara Beauchamp –

Would recommend this spreadsheet to others

Deb Joyce –

Poor customer service, no response.

Tricia Hamilton –

Item was accurately advertised and easy download.

Ren Cross –

Awesome and simple tool to use to calculate debt payoffs. I’m very happy with the purchase!

Michele –

Great products. I love them

Michelle –

I would say this sheet would be far better if it had a section to enter your starting cash, paycheck information so it could estimate how much monthly to give an accurate estimate of debt length. This spreadsheet assumes none of the above.

DeJuan McClendon –

Well built, helpful and easy understanding.

Jeff –

Great and easy to use spreadsheet to help you decide which method will work best for you. The only change I wish it had would be after you put all the debts in that it would then list them by name and by month which you should pay versus the number system charts. Overall I would purchase again.

genjay –

Robert Fulks –

Great item matched the description

Vikki Elwin –

I’ve been looking for something like this for a while. It does exactly what i need to help get rid of these bills!

Tim Heath –

Love that I didn’t have to do the work to create this spreadsheet….saved me a ton of time.

Lisa –

Saved me so much time!

Russ N Heather –

Angela Baustert –

Andrea Richter –

This is so visually appealing and mathematically beautiful! I love that I can easily plan debt payoff for multiple accounts.

Chatele Eagan –

Love the simplicity of the sheet!

Andrea Parry-Clarke –

Nisa Cooley –

Dashing Print Shop –

I never would have thought I’d pay money for a template but this one save me so much time! All of the formulas are already in there and they’re connected across all tabs. I would have never been able to create this on my own. Absolutely worth it.

Beverly –

I am beyond happy with my purchase. I only recently learned about the debt snowball and debt avalanche methods for getting out of debt, but I really didn’t want to have to do all the work to decide which was best for our situation. After ordering, I already knew I liked the workbook, but I ran into some issues while filling it out. Derek was INCREDIBLY helpful and quick to respond and even looked at my file to see where the issue was (it doesn’t handle debts of over 10 years, like a mortgage, which totally makes sense.) He also gave some suggestions for how to enter debts that are in deferment (like college loans are for most now). 11 out of 10.

Amy –

Had a little bit of an issue with getting the macros to work, but once I did, this was super easy to use.

Kellan Long –

I needed a good program to help conquer my debt. Works great!

Brendan Coughlin –

This was exactly what I was looking for!

Lesa Kapustka –

Was not what I was looking for exactly, but a nice calculator, nonetheless.

Sherrie Strange –

I love this spreadsheet!!

Kenyatta –

The seller was tremendously helpful when I had trouble opening the file.

Brandi Boney –

So user friendly! Well laid out!

Fernando Gilormini –

Lori Pagan –