Debt Snowball Spreadsheet for Excel and Google Sheets

$9.99

Time to get out of debt with this debt snowball worksheet! 💪

Works with Google Sheets and Excel

Top Features

- It will show you when you can pay off your debt

- Detailed but super easy and suitable for beginners

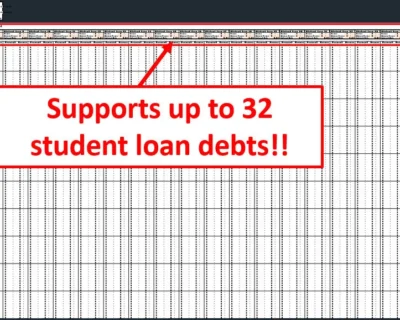

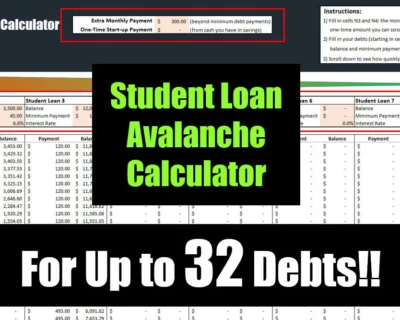

- Can handle up to 32 debts!

Description

Want to get out of debt? This debt snowball sheet for Excel will help you:

- Map out your debts,

- Show how quickly they will pay off

- AND It will show you how you can pay them off EVEN FASTER!

As seen on CNBC and Business Insider, this is the best debt snowball spreadsheet template for Microsoft Excel and Google Sheets that is out there!

I get it, it’s a big claim, but I actually used a *worse* first version of this to get out of debt myself (as seen in the articles). I succeeded, and so have thousands. Just think what this updated version can do for you.

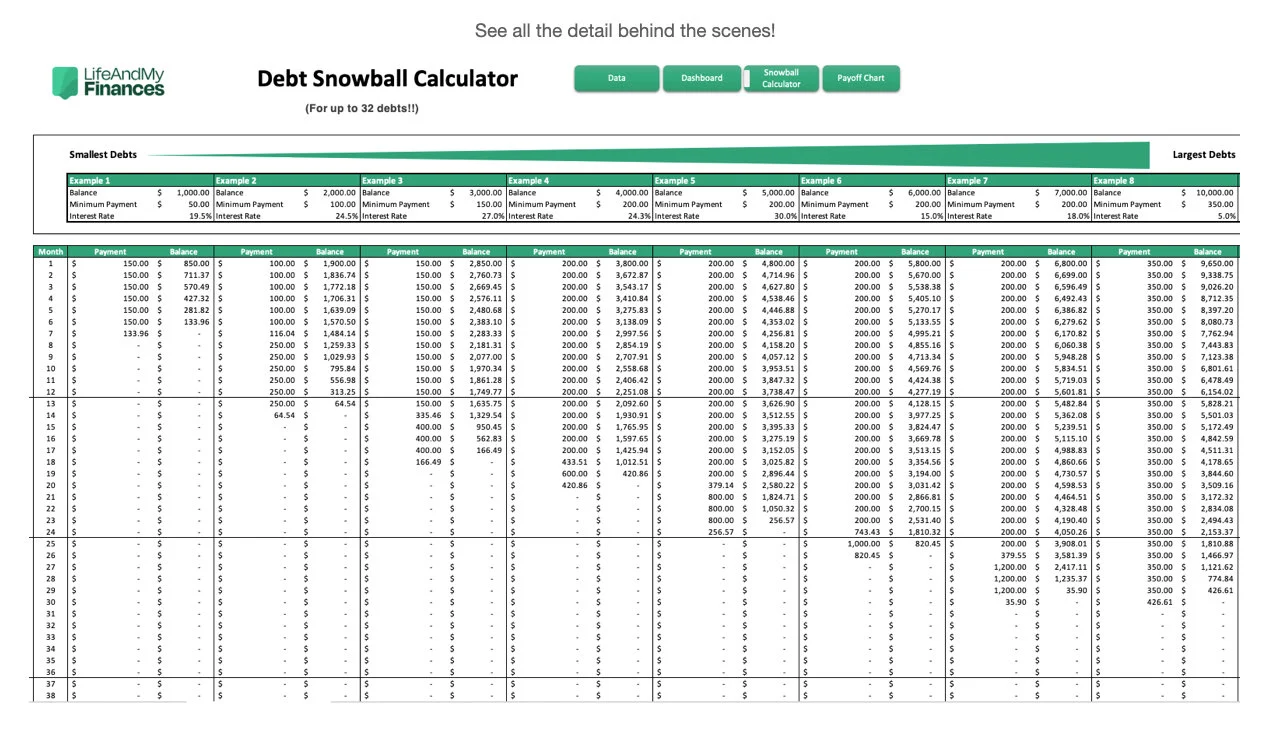

This debt snowball spreadsheet will:

- Handle up to 32 debts, so you can use it even if you’ve amassed a lot of debt.

- Show you when you can pay off your debt, depending on the strategy you pick.

- Create a plan that will walk you through each payment step by step.

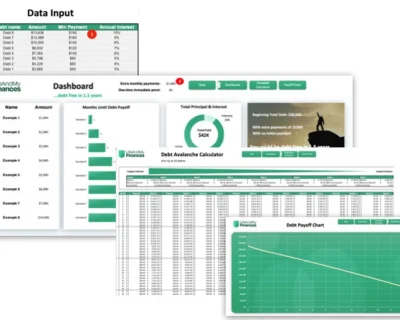

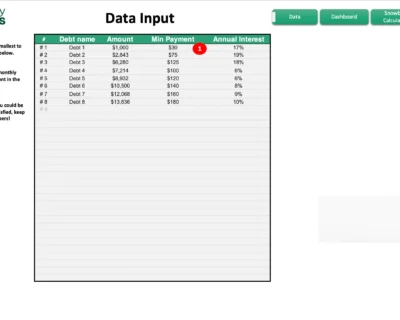

Still not sure? Here’s a sneak peek:

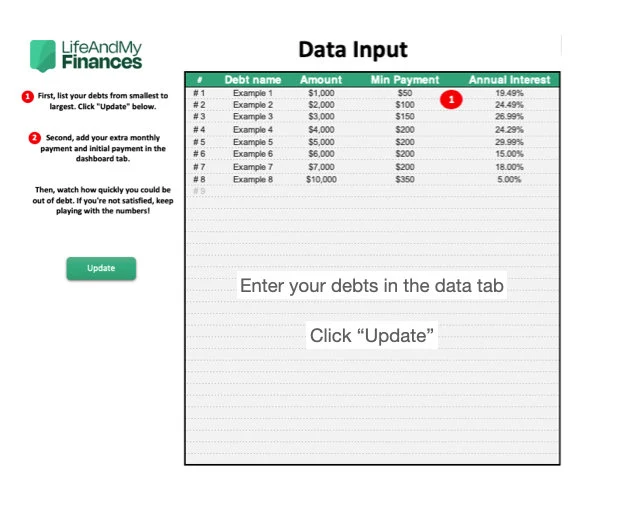

This is how it works:

- Just enter your debts, the interest rates, and the minimum payments.

- Provide the one-time amount you could put toward your debts immediately.

- Include the additional monthly amount you could put toward your debts.

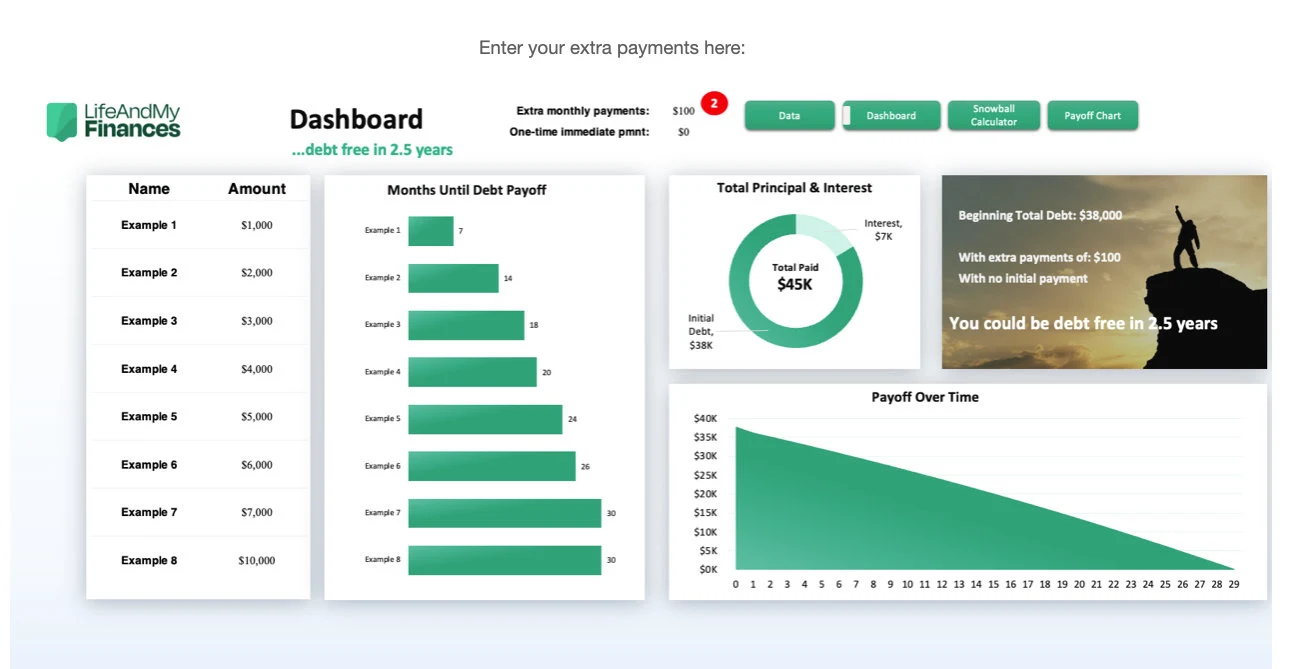

Once done, this snowball spreadsheet will crunch the numbers and show you when you’ll get to your debt-free future.

Easy, right?

Motivation is key when working with the debt snowball method, just like with the avalanche method.

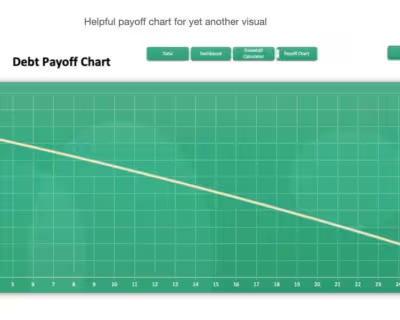

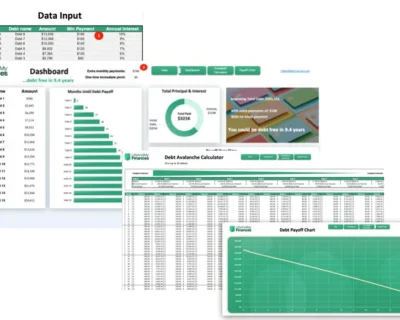

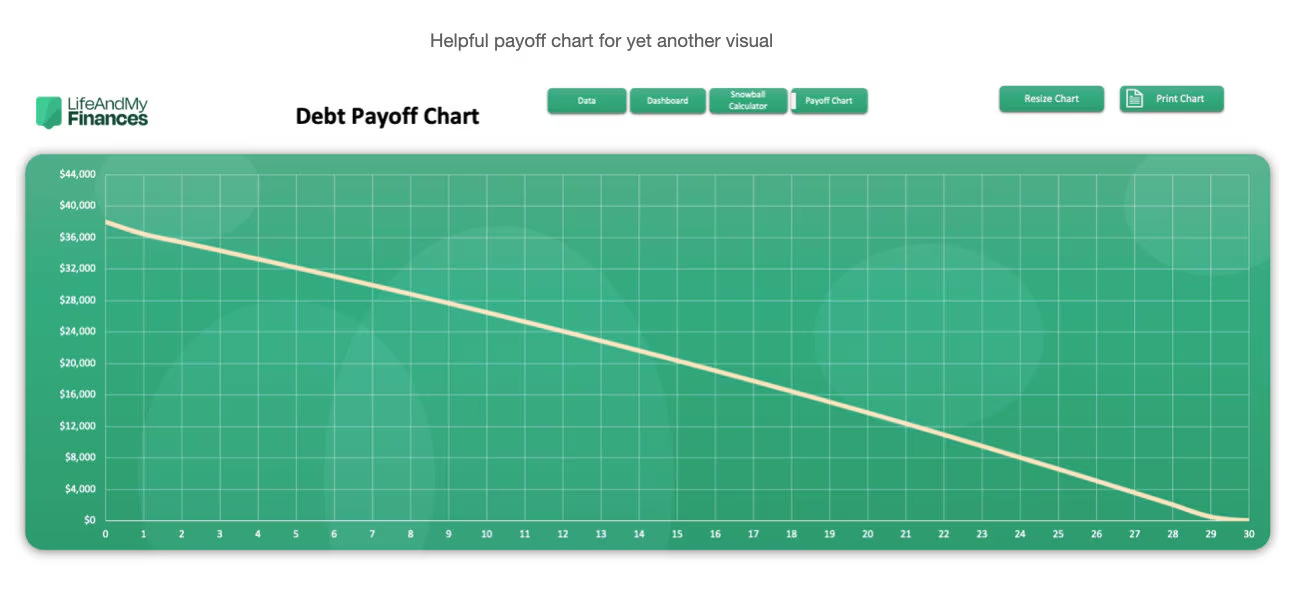

The debt snowball calculator will show you engaging, informative charts and graphs that will inspire you to stick to the program (or suggest better approaches!) 💪

Finally, you can go into manual override, and if the big payoff comes a bit too late for your taste, you can tweak additional payments to create your models.

Ready to start? 😉

When you download my snowball budget template, the first file is our newly updated template with a full dashboard. If you’re using Google Sheets, we have a download for that too.

You’ll see it upon purchase, simply click the link in the PDF and copy the Google Sheet.

Still not sure about the debt snowball method?

This debt payoff method is endorsed by the Kellogg School of Management and the Harvard Business Review as arguably the best, most sustainable get-out-of-debt strategy.

The debt snowball template is actually how I erased $116,000 of debt before turning thirty. I want to share this method with the world because it has life-changing potential.

Additional information

| Number of Debts | Up to 32 Debts, Up to 16 Debts |

|---|

303 reviews for Debt Snowball Spreadsheet for Excel and Google Sheets

You may also like…

-

Debt Snowball vs Avalanche Calculator for Excel and Google Sheets

4.82 out of 5$14.99 Add to cart -

Debt Snowball Spreadsheet for Excel and Google Sheets

4.63 out of 5$9.99 Select options This product has multiple variants. The options may be chosen on the product page -

Debt Avalanche Spreadsheet for Excel

4.55 out of 5$9.99 Select options This product has multiple variants. The options may be chosen on the product page

Related products

-

Student Loan Debt Avalanche Calculator for Excel and Google Sheets

0 out of 5$6.99 – $9.99 Select options This product has multiple variants. The options may be chosen on the product page -

Student Loan Debt Snowball Calculator for Excel and Google Sheets

0 out of 5$9.99 Select options This product has multiple variants. The options may be chosen on the product page -

Credit Card Payoff Template for Excel

4.57 out of 5$6.99 – $9.99 Select options This product has multiple variants. The options may be chosen on the product page

Lisa Sayin –

This was a great help to me

Sabrina Haney –

Great template to use for debt paydown.

kasey gonzalez –

Hard to navigate and customize

Kelley Cox –

It was a great purchase.

Niki Peacock –

Quick easy download and great for tracking debt

Amy Skowronski –

Saved me loads of time vs. building my own tool. Easily customizable.

Jamie Goldberg –

Great template and works perfectly

Tessa Gordon –

Item is just as described

Rachel Easterling –

This is a great debt snowball tracker.

Chad –

It was Helpful and user friendly.

Joseph Kirkland –

Great debt snowball spreadsheet. Perfect

Erin Zurcher –

Product is wonderful to get all bills down and see what you need for the future

kelly goldman –

great visualization of snowball payoff

Jill Hricz –

I liked this very much!

Jess –

Using every day to help tackle my debt

Nargis Fontaine –

This is helpful and lets me lay out all of my debt on one page

COURTNEY DELANEY –

Matched description given with product

Jacquelyn Boutot –

Easy to understand and use

Laura Gill –

Not the greatest but maybe I didn’t read description well

Tiffany Varela –

This is the second one I’ve purchased (because I lost the original file) either way totally worth it! Complete budget saver.

Natalie Stephens-Stewart –

Please do not force buyers to leave a review

Sam Carman –

Great spreadsheet for the debt snowball.

Arlesia –

Love this spreadsheet for budgeting.

Charity Gulley –

Very detailed, exactley what I was looking for.

Caitlin Baker –

Exactly what I was looking for!

Shauna –

It helps to see some light at the end of the tunnel.

Heather Harrington –

As someone who’s been on a journey towards financial freedom, I can confidently say that finding the right tools to manage debt is crucial. The Debt Snowball Spreadsheet is a game-changer. This spreadsheet is straightforward, clean, easy to understand, and most importantly, easy to use. This spreadsheet not only helps me visualize my debts but also creates a clear roadmap to pay them off systematically. Seeing those balances decrease with each payment is incredibly motivating.

Jessica Pavley –

Exactly what I needed – easy to plug and play

Suzanne Wansley –

Great way to start the new year.

Wendy Ban –

Great product, very helpful. Thanks!

Cameron Lawson –

It functions just as expected

Brian Williams –

Works great and helps paint a clear picture towards paying off debt.

Lori Bogen –

The purchase was an easy and immediate download.

Frannie Landry –

Not sure why this is requiring me to rate shipping because it was a digital download. Had no issues at all.

David Duke –

Great spreadsheet! This will be really helpful.

Maria Jose Pena –

Super helpful, easy to use

Mattie Bell –

Easy to use and very helpful

Samantha –

Just what we needed and the simplicity is perfection!

Alyssa Paulson –

Product Worked as it should

Jamie –

Great tool. Very well done.

Michael Monteclaro –

Helps me keep track of my debt! Thank you!

Erica Lasseter –

This is just what I was looking for! Thank you so much!

Zack Arbogast –

I accidentally purchased twice and they were very responsive to get my refund.

Angela Redmon –

This will be super helpful

Ashley McAnalley –

Love it! Very helpful for our family.

Ashley Beall –

Easy to use and very helpful

Faith Adams –

I am enjoying the spreadsheets.

Shannon Wax –

I love this spreadsheet! It makes the snowball method so easy to follow and know exactly where your money needs to go, which debts to pay down first. Thank you, very helpful!

rebekah taylor –

Directions are unclear. It does not give information when I scroll.

Sandy Lenichek –

very nice exactly as advertised Thanks !

Kathrine Whipkey –

Charles –

It did not match the image with darker look

Virginia –

Seller never contacted me after numerous attempts to reach out to them. Ended up contacting Etsy and charges were refunded.

Bryce A. –

Really helped break down my debts and gives me a solid view of how quickly I can pay them off with consistency! Excellent product!

Misty Coryell –

Thank you for the follow up and quick answer to my question.

Jada –

Works well enough. The dashboard seems to be broken on the download and the links don’t work well. But the tabs are there and the calculations look good.

Lauren Jean –

Nela –

I had no communication back when I needed help with the use of the spreadsheet for my needs.

Caitlin Shafer –

Michelle Stiger –

Jackie –

Griselda Rosas –

David Davis –

Great item to add to anyone’s budget calculations. The calculations work as they should and paint a great picture of how to get out of debt without defaulting or depending on someone else to take on the debt you incurred. Highly recommend this product.

Skin Savvy Cafe –

LOVE IT!!! It exceeds my expectations, fits the description, and is a great purchase.

Ciara Baker –

Callie –

Joshua Fuhrman –

Very helpful file! love it.

Margaret Osimani –

Rebecca –

so much easier than me trying to figure out my own spreadsheet!

Caitlin Baker –

Great product! Simple to use.

Lindsay Stewart –

Julia Fernandez –

Analey Garza –

Mayra Cortes –

Yolanda –

very quick download. just what i needed to help manage debt. the visuals and google doc formulas are easy to use.

Rebecca H –

The workbook is good, but not great. I am using it, since I bought it. One problem is that you can’t state how much you want to pay, or fenagle the worksheet to preferences. Another problem we ran into is that we are not able to share the worksheet. When I sent the completed worksheet to my husband for review, the worksheet wouldn’t apply any of the changes he made. It’s as if the code got lost when it was shared. This was a real hassle for us. Other than these issues, the worksheet is okay.

Sabrah –

Courtney porter –

Maeve Coleman –

Donna Allen –

great product…glad I purchased it

Ginny Simons –

Extremely easy to use, just wish there were a version for Numbers (Mac) as the excel version doesn’t transfer correctly.

Jenail M –

Jason Harrington –

Easy to use and works well.

Sarah Moyano –

Angie McGovern –

Meredith George –

Shani Robinson –

This is the best spreadsheet I have ever seen for paying off debt. Super easy to use and very helpful. So useful and it’s easy to see how your debt decreases with each month. This is highly recommended!! Thank you!!

Karina Riscos –

Good product good price

Chris Roux –

Heather Jones –

Ashley –

Shia Kohrs –

Anna Powell –

Loved having this spread sheet

Bobby Manglona –

cherese –

Nicole Davis –

Alexandria Beaudry –

The item matched the description and took the legwork out of a document I’ve been trying to find a way to perfect for a while. A couple features don’t seem to work, but the bulk of info (what I need) updates well.

Sara Lauritsen –

Danny –

Sarah Frohlich –

great file and fast download

Azuredee Doyle –

Great! We love it! Thanks!

Em Hunt –

The sheet came to me with messed up columns. There is a column that doesn’t carry over. I’m not an excel wizard – I’m sure I could fix this if I tried, but the equations are complex. What’s way easier is getting a free version from a google search and just copy and pasting it to extend the columns. \n\nI did message the seller to tell them that my file was messed up. His response is that it wasn’t. It very clearly is, but he dismissed my concern. \n\nUnfortunately for me, and you if you purchase this, the error is in about the second or third debt column which makes the other 12 columns useless. None of your payment carries over after the error column, so there is no snowball. Just looking at the numbers that you’re already paying.

Paul –

Jose –

Great way to manage debt.

Casey Zweigle –

Jessica Scott –

Easy to use.

Amanda –

Wizen D –

Dana Thomas –

Great file and easy to use!

Nilsa Sanfilippo –

LaQuanna Franklin –

Megan Nicholson –

Great tool!! Appreciate the ease of use!

Denise –

Easy to use and very helpful.

Erika Seiberlich –

Amanda Y –

Love it and easy to use!

Travis Stahlhut –

Exactly what I was looking for

Adrienne Keenan –

Shaylyn –

Can’t make edits once your credit information is in. It messes up the Debt Snowball Calculator. Mine is telling me to not pay two of my cards for several months ???

Randa Lynnae –

Roselynn Rodriguez –

This resource is very simple to use and includes very motivating features. The seller was extremely helpful figuring out a little technological glitch. We’re on our way to follow the clear plan outlined in our Debt Snowball Spreadsheet!

Melissa Mahaley –

Kyndra –

Christine Murphy –

Julio –

One of the files continues to give me errors with the formulas.

Trish Bavaro –

Not exactly what I was looking for but It works very well

Gina –

I cannot edit or put in my own information. It has three red marks where it looks like I should enter my own info but nothing works. Bummer because I was looking forward to getting my financial life together!

Mandy Lee –

It was ok for getting started.

Nicole Cardone –

David Allen Akins –

An excellent sheet, used daily

a a –

Very fast delivery, thank you!

Tracy Raketic –

Works wonderful! Helped me visualize my plan to be debt free, including the house.

Fatima guy –

Seller is A1 Was very honesty and super friendly. This is helping me big time.. Thanks for answering all my questions.

Fatima guy –

The best one yet. Seller is also really dope and kind. Easy to use and straight forward. Thank you so much. Its beens so helpful getting me back on track.

Laura –

Great seller!

Trista Dewitt –

Tali gregory –

Brittany Leatherwood –

Works as intended and expected.

Mary Ellen Coumerilh –

Well done, but not quite what I was expecting. It may be that I misunderstood the purpose of the worksheet.

Reechelle –

Quick delivery. Download works just as described.

Deseret Trading Company –

Amanda Barnett –

As advertised

Magaly Yambo –

Claudia Mazuelos –

Nicole Brantley –

This was exactly what I needed to get my bills in order, now I have a visible plan.

TRD Designs –

Works as expected. Thanks for adding additional debts. I like the layout of this way better than others I’ve seen.

Inessa Lechner –

Misty Grover –

Lisa Harper –

Michelle Lee –

Unable to access. Says there is a virus attached so unable to access. Am not happy

Sarah –

Rachel C –

Jessica –

Helped me have a visual of everything in an organized way.

Emily Law –

Ysleta Mission Gift Shop –

Super easy to use and time saver!

Melissa Juneau –

Super easy to use! Just populate and the spreadsheet does all the work for you. Immediately provided a sense of relief when I could see the timeline to payoff the debt.

Johanna Fay –

Erica Pence –

Perfect for my needs. Thank you

Colin Com –

Karina Browning –

Sign in with Apple user –

Angela Hohula –

Curtis Hopkins –

Very easy to use! I can finally see the light at the end of the tunnel

Laurie Barton –

Great excel sheet that will get me on the road to financial freedom thank you so Kuching!

Sean Mc Andrews –

Please write at least six words. It’s Great!

Kenneth Maddox –

Sandy Androckitis –

This may be user error, but when I entered information into the Debt 1 category, the amounts actually went up instead of down, which was not at all the point! 🙁

Danielle Snyder –

Nina Strother –

Allison Heller –

Erika Staggs –

I filled this out and feel like I have a goal. It is a very helpful tool

Alison Everest –

Jordan Flannagan –

Deborah Wilt –

I can already see the benefits of this. Very excited about implementing it and appreciate its simplicity. Great investment! Thank you!

Jonathan Cowley –

It works! Simple to use and intuitive!

Corina –

Highly recommended; Easy to Use

Ana Larson –

Helpful. Informative. Easy to use.

Sara Coombes –

Krista Schnurbusch –

Samuel Powell –

Ericka Hebebrand –

Mirenda McArdle –

Monica Jones –

Patti Farrell –

Brittany –

this helps me so much

Walmsley Family –

ADS Cute Designs –

Kristi Parrish –

Love it, super helpful

Sarah Shepard –

Stephanie Carter –

Love this little calculator. Makes it a breeze to calculate debt payoff

John –

. . . . .

Diana Dietz –

I think when sending files for download, someone from quality assurance should download the file to see what the potential customer may be looking at when they open it and verify all the features work. But because I work with Excel, I was able to fix the issue, so I won’t be asking for a refund. That is all.

Kiara –

Gaynelle Sanders –

It wasn’t quite what I was looking for.

Caylen Williams –

Excellent customer service!

Christie Whitzell –

Courtney Marie –

Super easy to use and exactly the tool I needed. Thank you!

Sign in with Apple user –

Product as described. I am able to see light at the end of the tunnel and based on projections will have 32k paid off in 18 months

Holly George –

Dexter Hollen –

I tried to save this file in Excel, however, had a problem in trying to do so. This was a few days ago so I have to revisit it and try again. As I recall it appeared to be in PDF format that does not work for me. Perhaps I am wrong, I will have to look at it again.

Christi Reinig –

This is an amazing spreadsheet that is helping us pay off all of our debt quicker than we could on our own!

Maya Methot –

It’s perfect! Exactly what I needed and it’s given me a great sense of control to see everything organized this way.

Jarquelle –

i love this product. amazing

wendy de flart –

Mandi Stover –

T J –

is matched the description well

Vanessa –

Leonard Baker –

Exactly what I needed and if I stick to it I’ll be debt free again in about 18 months!!\nDerek is a great inspiration, as well as takes the time to make sure things are working for those of us who are Excel illiterate. I messed up on mine and he was kind enough to take the time and effort to fix it for me…above and beyond customer service much appreciated! Thank you Derek!!

Lissette –

Mel –

Danielle Murphy –

just what i need. puts it all into perspective and make all this easier to look at and not get discouraged

Daniel lowery –

Great spreadsheet that was super helpful

Danny –

Been using the free version of this spreadsheet for years and finally made the purchase now that my finances have changed drastically. So glad I made the purchase! Best debt snowball spreadsheet I’ve found!

leineskate –

Just what I needed. I helped me formulate an action plan. I will get out of debt.

rhonda yates –

Very useful tool in my debt reduction strategy!

Jody Edwards –

Macros didn’t work for some reason but the important part of the spreadsheet was incredible! Managed all 13 of my debts and showed me how to pay them down in less than 3 years! Amazing!

Tonneisha Owens –

The spreadsheet loads data very slowly. IT took over an hour to input all the information that I had right in front of me. dont waste the few bucks

Jessica Arcoraci –

jessica bird –

Yesenia Serrano –

I got the free one and loved it so much I bought it because is simple and organized and to the point

Michelle –

Maria Avila –

Stacy –

Laura B –

Great spreadsheet, thanks so much!

Shannon –

LET’S GET STARTED PAYING OFF MY DEBT!!!

Angie –

Shawna Salkil –

Very helpful and easy to use

Julie –

User friendly and works great!

Damera Blincoe –

I love this spreadsheet 😊

T Smith –

Antonia –

Michelle Bahr –

Very helpful for the price!

Stephaney Alexander –

Just what I was looking for to get a head start on my debt payoff. It’s easy to use and can be updated quickly.

Stephanie –

My favorite debt tracker that I always use.

Amanda Cartagena –

Sign in with Apple user –

DID NOT WORK FOR ME

Juana Lopez –

Jasinda Muhammad –

BJ Perkins –

LILY NAVAS –

TO MUCH FOR WHAT I NEEDED

Redd Robins Room –

Great product! I can actually breath a little better after entering all of my information and seeing a light at the end of the tunnel! Great customer service as well! Highly recommend.

Leslie –

Easy to use, very happy with this product.

Brittany Venturella –

Meghann Collins –

Katrina Carmean –

Mandy Haggan –

This is a great product! I know it sounds odd, but this spreadsheet has given me hope! After spending YEARS drowning in debt and unsure where our how to TRULY make a difference, this spreadsheet lays it all out. You can adjust it as you need (interest rate changes, or your monthly payment changes, etc) and you can even print out the graph to see the decrease happening for motivation! Wish I had this a long time ago. My $275,000 debt that I was planning on taking care of in 40 YEARS is showing gone in just over 6 YEARS… it was SO WORTH MY MONEY

Tricia Ann Sribonma –

Works perfect! Thanks so much!

Kim Novicki –

Priscilla Garcia-Meier –

Super easy to use! Great spreadsheet!

Annie Boose –

Brittney Mancil –

Great product! Works flawlessly! Thank you!

Stephany Cox –

I am very pleased with this purchase! So easy to use. Thank you!

GIJJA’AS –

I really liked the product! Its easy to you and worth the small amount i paid for it.

HS DW –

Very useful for my debt tracking!

MELISSA APPLE –

Kandice Meyer –

natasha king –

great way for me to keep track of my debts and great at giving me a good idea of pay offs. very easy to use

Cassandra –

Marianne –

Laid out well, great visual.

Annie Claus –

I love the product however the second page does not work for me or perhaps I just don’t understand it. Overall a great tracker for paying off debt.

Four Pines Company –

This item was exactly as described.

Kristan Boone –

Great quality! Matched the description and went above and beyond my expectations.

Brittany –

Very user friendly, thank you

Jennifer Leconte –

Michaela Johnson –

Dawn Cranmer –

Exactly what I needed to help with finances. Thank you.

Darcie Velez –

It was as well worth the money to get a great Excel file! Saved me lots of time (and better than I could have done anyway!) Thank you!

Anne Bruns –

Mirjana Filipovic –

Awesome tools I have been using for several years.Thank you

Tyson Yates –

Great product, would buy again.

Sarah Lewis –

Shannon Williams –

did not work for me

Stephanie Goss –

Amy Moore –

It has made me feel more confident and prepared to tackle my debt!

Ruby’s Daughter, LLC. –

Very easy to use and is a help.

Emily –

Beth McClellan –

Easy to use and extremely helpful. I have a perfect debt payoff plan due to this spreadsheet. Worth the money.

Suzanne White –

this is a great spreadsheet! really keeps me on target and helps me plan my finances!

Samantha –

Rhonda Delasbour –

Just what i needed! And love that its a bigger format

Tiyanna –

Cory R Havens –

Perfect debt snowball template to understand and use!

Hillside Ambassador –

Nelisa Hernandez –

Morgan Berg –

Item worked as described. No issues. Would order again.

TheresaP –

Jeni Horton –

Adam Kyle Landrum –

Lorene –

Saved me a lot of time from making this on my own. Works great!

David –

GREAT PRODUCT I AM LOVING IT

Mel Mel –

Very easy to use and more than met my expectations! Thank for a great tool!

Deborah Rubio –

Audrey –

User friendly and easy to download

Nicholas Grossi –

Great product and extremely needed for my financial peace.

Victoria Bill –

Just what I was hoping to find!

Pamela Johnson –

toni ware –

Dave T –

Great file. Very useful. Highly recommended.

Ti Ti –

Mary Brown –

So easy to use, hope it can help me

Brucella Jauregui –

Probably the best excel sheet I’ve ever discovered! This has been so helpful when figuring out my finances. Easy to use and understand.

Bree Lutzow –

Very very easy to use!

Traci Lorch –

I was very happy to find this tool. Our goal this year, 2022, is to payoff debt. This gives us a great overall picture and will help us track our progress. That is very motivating!

Anissa Hamilton –

This tracker is easy to use with quick start up. It only took a few minutes and now I am all set to be debt free in less than 2 years.