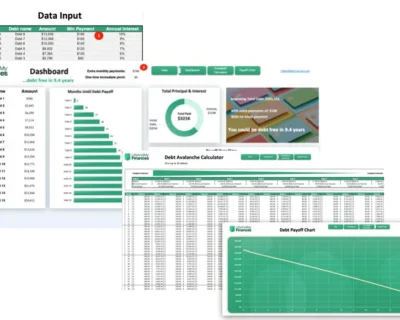

Debt Avalanche Excel Template (for up to 32 debts!)

$9.99

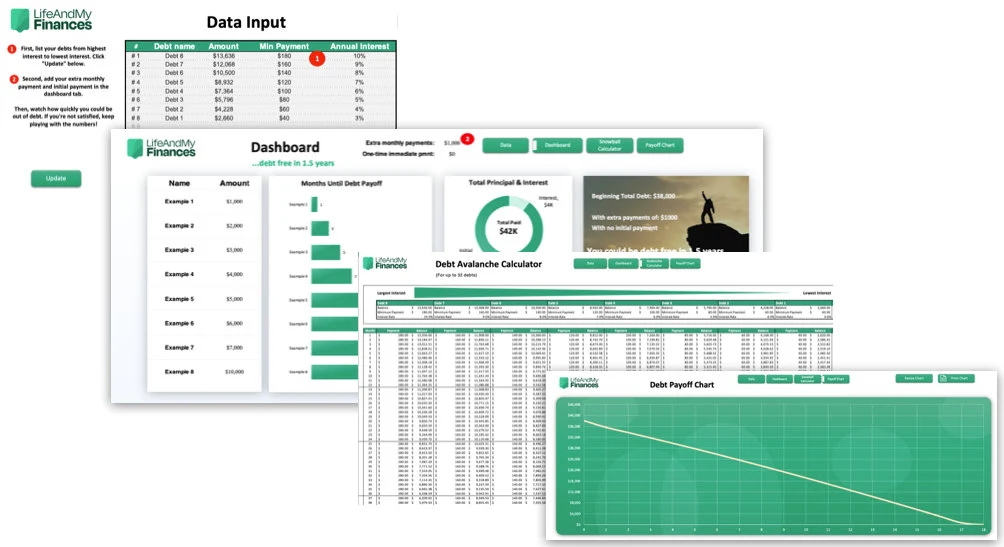

NEWLY UPDATED TOOL WITH INTERACTIVE DASHBOARD!!

Want to get out of debt?

This is the BEST debt avalanche Excel template out there! With room for up to 32 debts!

Description

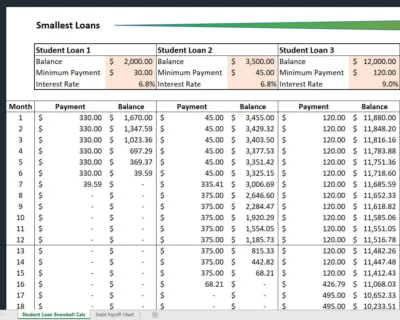

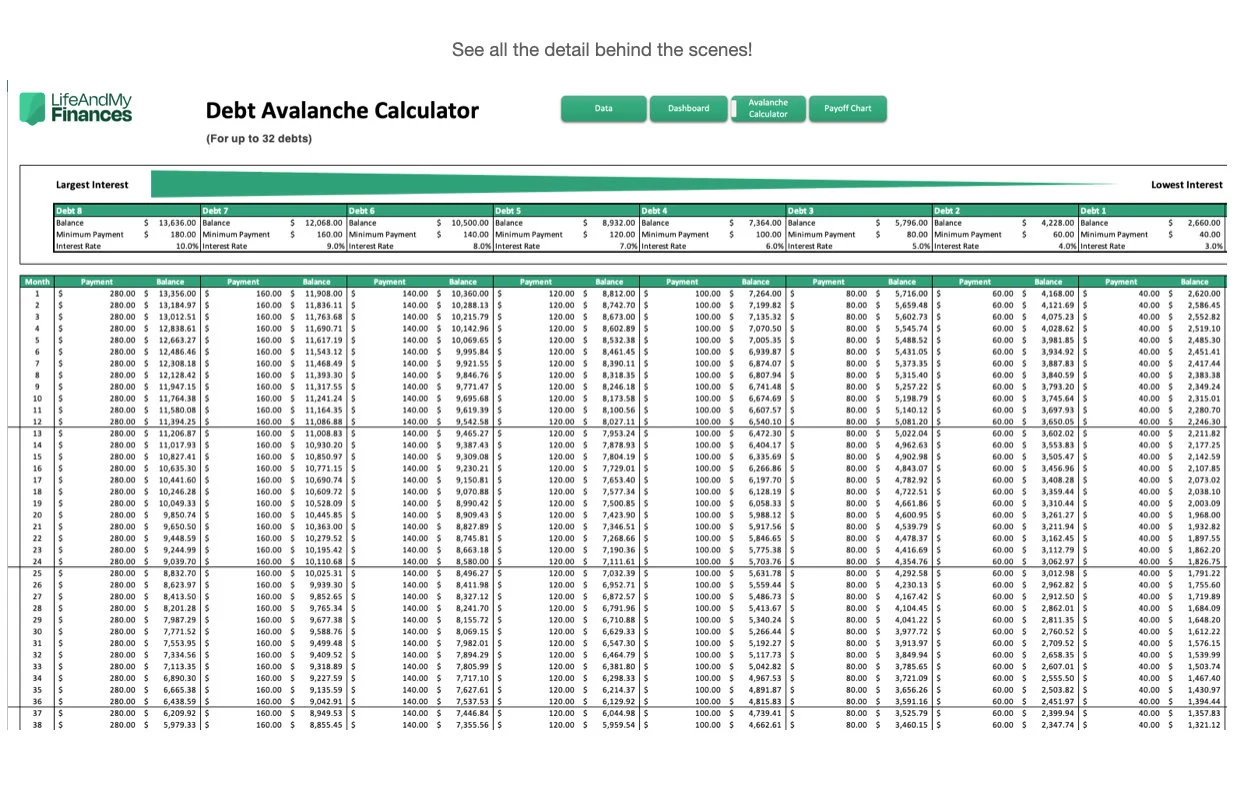

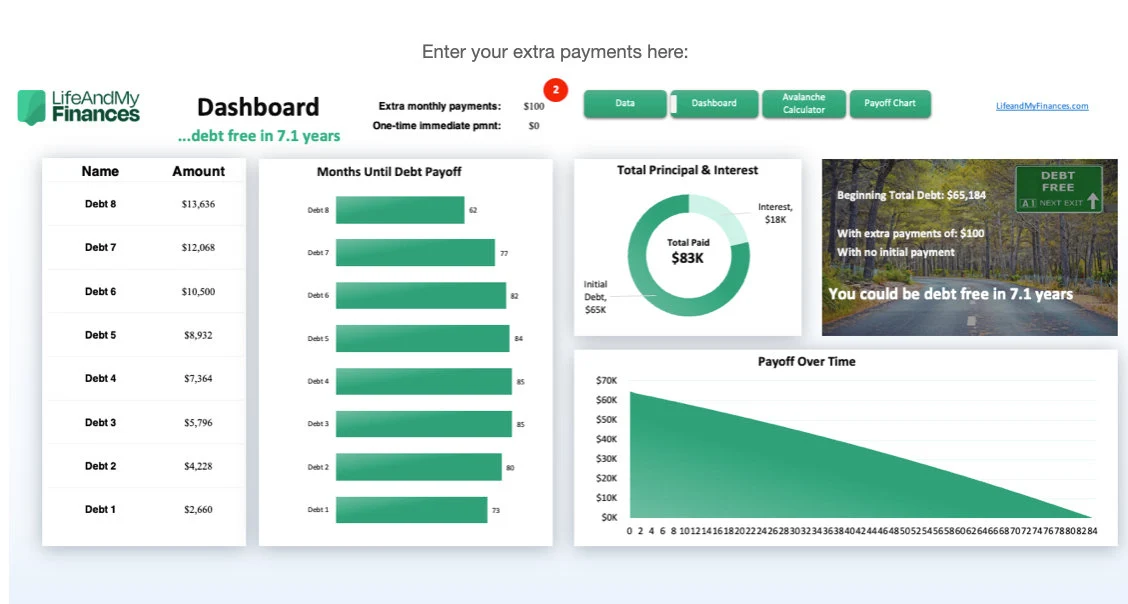

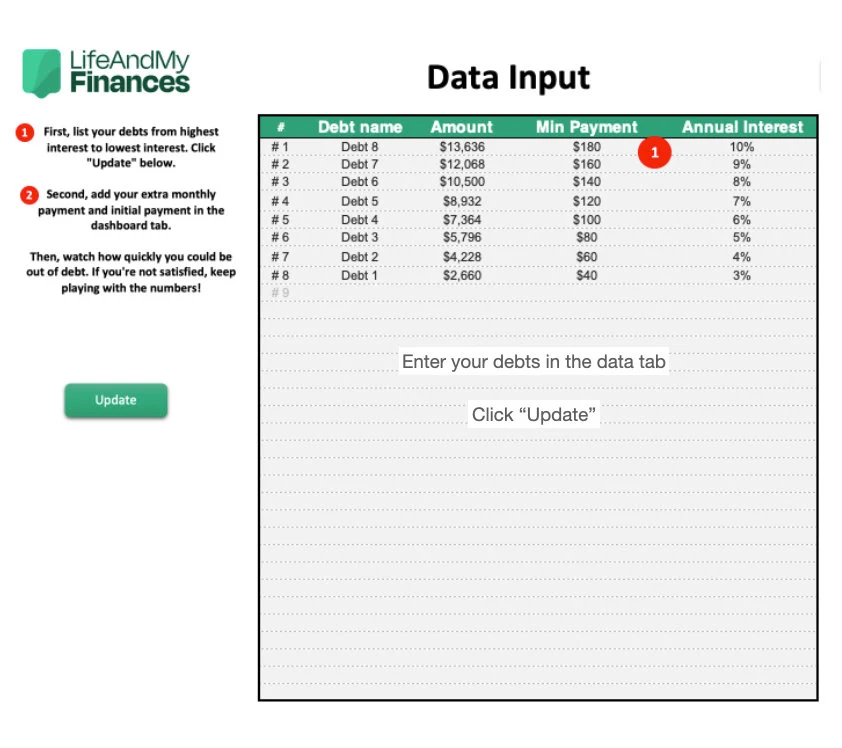

This tool will allow you to list out your debts with the highest interest first, all the way down to the lowest interest last, and tell you how quickly you could pay off all your debts with the debt avalanche method!

Just enter your debts, the interest rates, and the minimum payments. Then enter the one-time amount you could put toward your debts immediately. And finally, enter the additional monthly amount you could put toward your debts.

Then BOOM!! You’ll be able to see immediately how quickly you could pay off each debt.

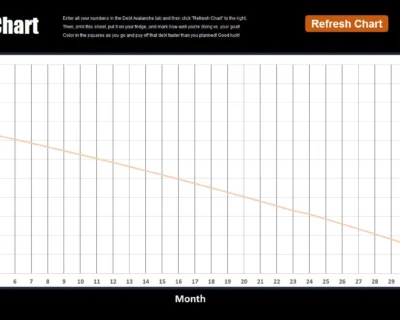

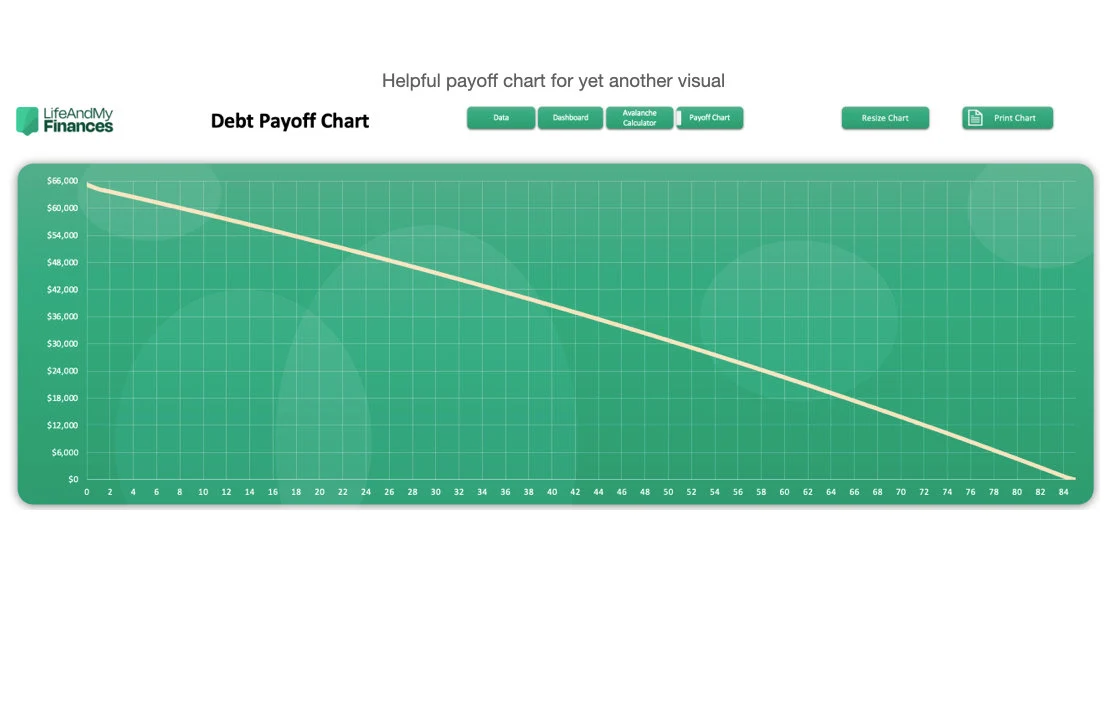

You can visibly SEE each of the debts and how quickly the balance will reduce each month.

And, best of all, if you don’t like how long it will take you to pay off your debts, you can just tweak the additional monthly payment amount! Then immediately see how much more quickly you could pay off those debts!

This tool is awesome for motivation. I bet you could pay off your debts faster than you think!! Check out this great tool!

36 reviews for Debt Avalanche Excel Template (for up to 32 debts!)

Related products

-

Credit Card Payoff Calculator Excel Template (16 Debts)

4.59 out of 5$3.99 Add to cart -

Debt Avalanche Payoff Calculator Excel Template

4.95 out of 5$3.99 Add to cart -

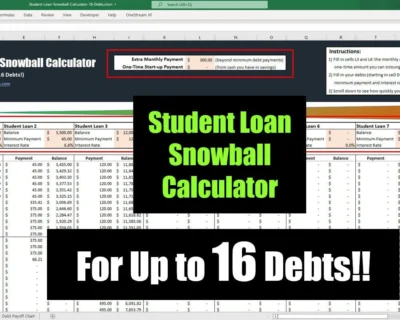

Student Loan Snowball Calculator 16 Debts

0 out of 5$3.99 Add to cart -

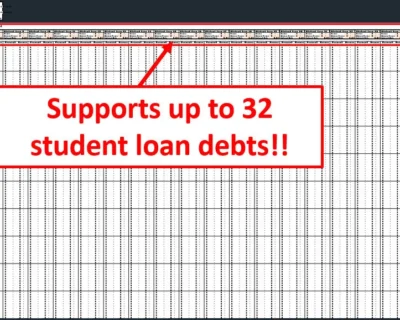

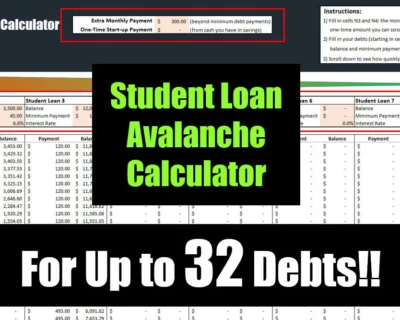

Student Loan Debt Avalanche Calculator (32 Debts)

0 out of 5$9.99 Add to cart

Gary McClain –

A bit confusing at first but wasn’t long before I understood the necessary entries.

Kathy Kuhl –

Easy to use and update. And to see how all my debt can be paid off quicker is a blessing. Thank you 😊

Sheri –

Links are broken which makes the spreadsheet unusable.

Jack –

Scott Mcphail –

Great product. But I need more than 10. But I love what I see

Lorna Hartman –

Be aware that you can’t enter exact interest rates, only whole numbers. If your interest rate is 5.6%, it will round it up to 6%.

Anita Arteaga –

Not easy to use or understand

Jacquelyn Boutot –

Exactly as expected, would recommend.

Melody Calder –

Great to see the debt payoff plan in writing and the calculations seem to be on point. The only thing I found is to make sure on the ones with the same interest rates and want to pay off one before the other, I have to list them in the order I want. Not a bad thing, just advice for those who have a long list.

Nina Lopes Dippon –

Sign in with Apple user –

So easy to use!I had it set up in about an hour with a plan to pay off my debt that I can realistically handle. Thank you!

Chris Beasley –

This is an awesome and helpful tool!

Gayle Woods –

Really good quality. Absolutely loved it!

Mandi Combs –

Great tool, hopefully this will help us get in the right track.

Hayley Wood –

Cannot wait to use this to help with my finances.

sean munfield –

Very helpful in prioritizing debts – put together a great plan now that I am newly married

Whitney Ronzello –

Cassandra –

Meghan Finley –

Nina Sharp –

Alexis Hepburn –

Joe Palazzo –

great

Clara De Leon –

Noel Byrd –

Garolina Cahani –

Kerrie Shirley –

Rebecca –

Elizabeth Green –

Jose Rojas –

I thought that there was more automation in this spreadsheet. I could have done this myself.

Tashina Chuculate –

I had purchased another one from someone else before and it did not hold nearly enough information and this one came up and is perfect! Figures it all out so all I have to do is set up the payments

JOICE MADUAKA –

Jennifer –

The quality is as described

Sarah Furr –

I have used the snowball sheet in the past and now this avalanche sheet. They are very useful and give visuals to accomplish your financial goals.

Courtney Stains –

SAVED my life! This spreadsheet guided us to the path of being debt free in 2 years! And even mortgage free in 8! It has motivated us! Thank you so much!

Elizabeth Huff –

Nicole –